These days, you'd be hard-pressed to find an business that isn't advertising on social media. But when it comes to financial service providers, social media marketing can become a double-edged sword, or worse a compliance nightmare that results in major fines from the SEC, FINRA or the FTC.

But the risk of fines or sanctions from the major financial governing bodies clearly don't outweigh the benefit of being on social media for financial service providers. According to the Putnam Social Advisor Survey findings from 2023, 94% of financial advisors are using social media for business. And though it is trending downward in recent years after the New Marketing Rule came into effect in 2022, 81% of advisors in 2021 reported gaining clients through social media.

It makes sense. Social media has become arguably one of the best places to advertise products and services. With the right content, posting on social media can boost brand awareness, authority, and of course, sales. If used correctly, in conjunction with social media archiving, it can be very beneficial to businesses within the financial sector.

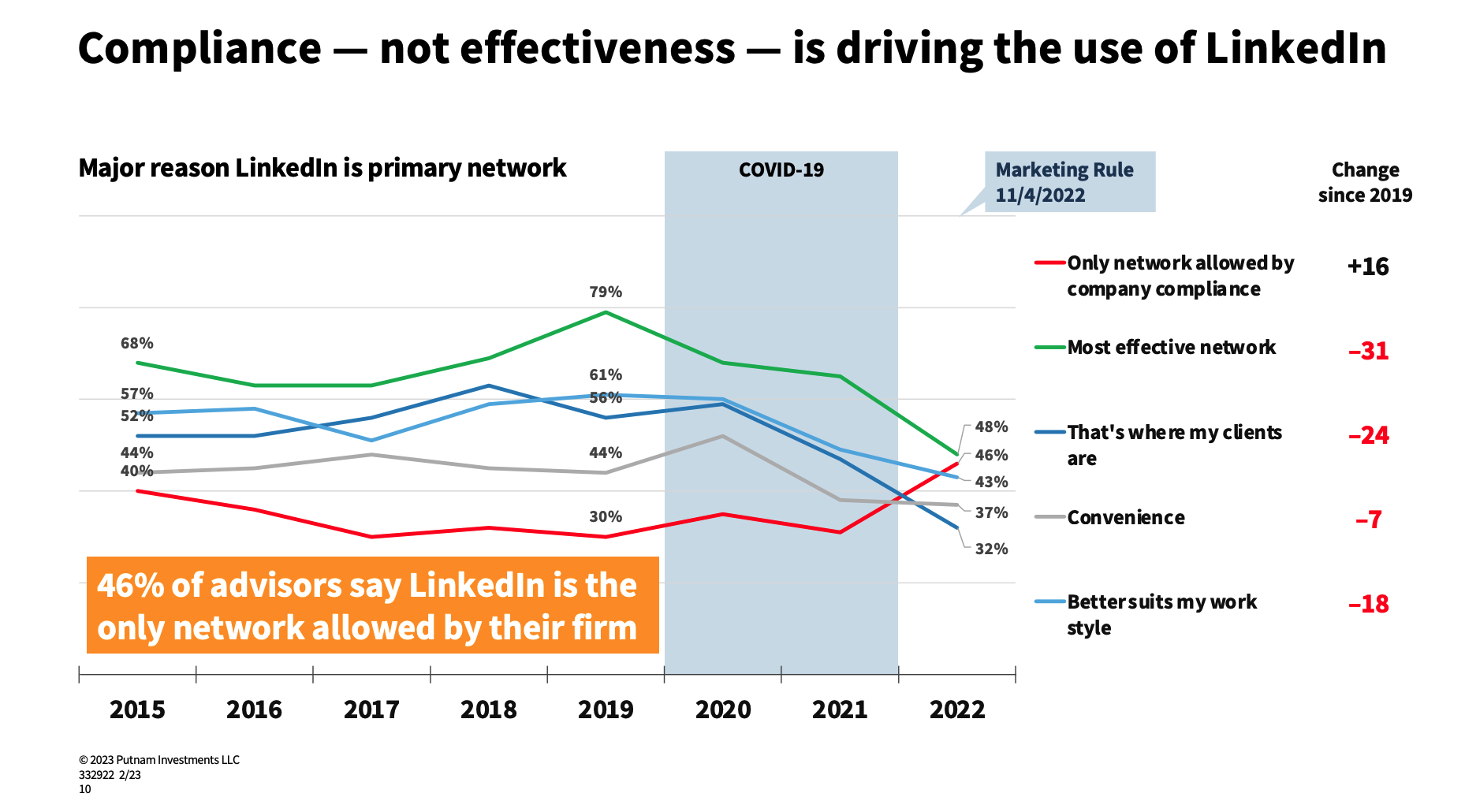

However, not all social media networks are created equal in the eyes of financial advisors. In fact, since COVID-19 and the New Marketing Rule put into place in 2022, financial advisors using sites like Facebook, Twitter, and Instagram are steadily decreasing. The major winner, the primary network for 4 out of 5 advisor, is LinkedIn—but not for the reasons you think.

In the survey, only 48% said LinkedIn was the most effective network for social media marketing, so why then is it the platform of choice for 91% financial service providers?

The answer is compliance.

46% of advisors from the survey said that LinkedIn is the only network allowed by their firm.

Source: https://www.putnam.com/static/pdf/Putnam-Social-Advisor-Survey-2023.pdf, Putman Investments LLC

Again, this makes a lot of sense. The SEC has been dishing out some astonishingly high fines in the tune of many millions of dollars for non-compliance with recordkeeping regulations involving off-channel communications. Compliance has become top of mind for financial services providers, if it wasn't already.

One way to reduce risk, which these company's seem to be adopting, is to minimize the number of platforms where you have a presence. This allows for easier monitoring and supervision, but also helps reduce the burden of social media recordkeeping.

The obvious side-effect of limiting their online presence is radically reducing their potential reach and potential customers. Demographics vary significantly depending on the platform, and the effectiveness of the platforms for marketing or even gaining any kind of audience are also quite varied. Depending on your target market, this could mean that LinkedIn is not the right platform for your content, and it won't be as effective for you.

So how can financial service providers increase their reach on social media and maximize their advertising potential if they're limited by compliance concerns?

The answer is to get a better social media archiving solution. And we'll get to that and what it looks like, but first, we need to understand how FINRA and SEC's recordkeeping rules apply to social media.

Understanding Your Recordkeeping Requirements

Social media provides a more flexible platform for advertising than many other channels. It has the scope to reach a wider audience and benefits from a real immediacy in terms of it’s reach. In this way, it can often feel more informal than a traditional advertising campaign.

However, even the most basic Instagram post or tweet can be considered advertising in the eyes of regulators under the SEC's New Marketing Rules. As such, all social media content posted on behalf of your business must comply with applicable FINRA and SEC regulations.

Meeting FINRA Standards and SEC Rules

The Securities Exchange Act is a wide-reaching set of rules governing the financial services industry—but over the last 15 years, they've had to adapt quickly to a rapidly changing digital landscape.

In particular, SEC Rules 17-a3 and 17-a4 pertain to recordkeeping a firm's business communications. They outline what constitutes a record, how long they should be kept, and in what formats they should be kept, including addressing electronic storage of records.

FINRA issued Regulatory Notice 10-06 in January 2010, further clarifying these rules in the context of the rise of social media platforms.

FINRA Regulatory Notice 11-39 was issued the following year with further details of "Guidance on Social Networking Websites and Business Communications."

The Big Problem with Social Media Recordkeeping in Financial Services

Compliant recordkeeping has always been important for financial service providers, but when it comes to social media, it's not often as straightforward a process. Most social media platforms do not have accessible, legible backups of your content that would be easy to produce or review in case of an audit. And you can't just screenshot your posts and put them in a folder on your desktop for the required retention period. That's because these regulatory bodies have outlined very specific requirements for the storage of a firm's social media data, including:

- Electronic records must be preserved in a format that cannot be altered or destroyed for the specified retention period.

- Records must be indexed, readily accessible, readable, and capable of being reproduced in printed format.

- Records must be retained for specified time frames (generally three to six years, with the first two years in an easily accessible place)

That means native data exports or screenshots from your social media accounts simply do not cut it. By the time you get around to downloading your data, posts could be edited or deleted—leaving you with incomplete records and at risk of non-compliance. Screenshots are easily manipulated and therefore not acceptable for capture or preservation of records. Forget trying to find specific records in a sea of screenshots and random data if you're trying to produce them for an audit. Accessibility isn't just about being able to access the records, it's about being able to find and access specific records, and producing them in a legible format. With screenshots and data dumps, this is nearly impossible.

And that's why social media archiving is so important for financial service providers.

Social Media Archiving for SEC & FINRA Recordkeeping Compliance

Archiving of social media content does not need to be nearly as taxing or time consuming as the aforementioned (and non-compliant) screenshotting approach. Automated solutions exist to make it easy to keep and produce accurate records and give you certainty that all of your records are captured and stored in compliant formats.

Social Media Archiving Software Checklist

If you're looking for social media archiving software (and you should be if you don't have a solution in place already,) here's what to look out for when you're evaluation solutions:

- Can it capture and produce in the native formatting of the original platform, with all context included?

- Does it store your records in WORM format, with digital signatures or hash values?

- Can it capture posts, comments, and reactions in real-time, before they are edited or deleted?

- Does it have full-text search, allowing you to find specific content in the records across posts and platforms?

- Can you review the records as needed before you export?

- Can it capture and note edits and deletions in both posts AND comments?

- Can it monitor for data loss prevention and flag specific keywords or number strings for review?

- Can you set retention periods for how long records should be stored?

- Does it allow you to export records in compliant, readable formats?

- Is the provider experienced in dealing with SEC and FINRA recordkeeping compliance?

- BONUS: Does it allow you to easily share records with auditors through private access links, streamlining audits or compliance reviews?

Keep Your Firm Compliant with Social Media Archiving from Pagefreezer

Pagefreezer's Social Media Archiving software meets all of these requirements. We've designed our software specifically for compliance, ensuring defensibility and accessibility. We also pair compliance solutions with world class customer service that can get you up and running fast. We've helped thousands of financial services firms around the world maintain peace of mind with compliant social media archiving and we'd love to show you how.

If you'd like to learn more about how we help financial services providers stay compliant, let's chat.